Order Management and API

Use your prefered order type in any market and benefit from Wyden's best execution capabilities and advanced API options.

Supporting all order and trading types

- Support for virtual spot positions

- Supported order types: market, limit, stop, stop limit, trailing, bracket

- Multiple time-in-force options: day, good-till-cancel, good-till-day, immediate-or-cancel, fill-or-kill, at-the-open, at-the-close

- Support for spot and margin trading

- Custom order properties to add custom information to your outgoing orders, e.g., venue-specific fields or algorithm-related properties

- Custom pre-trade checks, e.g. Maximum trade value, Maximum position value, Maximum order quantity, asset type white-/blacklisting or order type white-/blacklisting

- Multi-account functionality with support for sub-accounts, managed accounts and fund accounts including:

- Venues that support multiple sub-accounts (using the same API keys for all sub-accounts)

- Venues that do not support sub-accounts (using different API keys for multiple accounts)

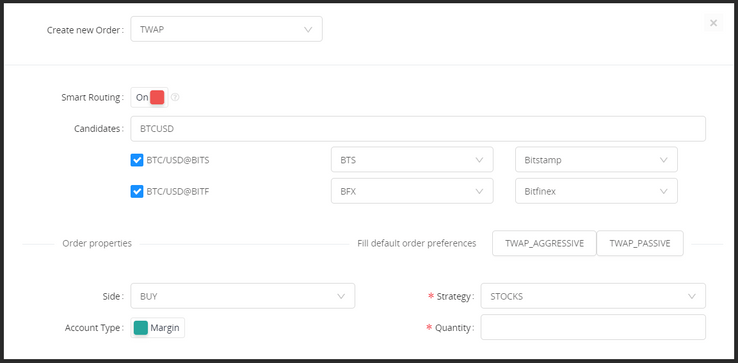

Execution algos and Smart Order Routing (SOR)

The AlgoTrader infrastructure offers a wide range of best execution capabilities to execute large orders with minimal price impact.

- Built-in Smart Order Routing (SOR) execution algorithms which allow to gain better execution prices and minimize market visibility and impact

- VWAP (Volume-Weighted Average Price)

- TWAP (Time-Weighted Average Price)

- POV (Percent of Volume)

- Iceberg

- Sniper

- Market Sweep

- Smart Market, Limit, Stop and Stop Limit

- Trailing Limit

- Target Position

- Broker-side execution algorithms (VWAP, TWAP, Percent of Volume, Accumulate/Distribute)

- Full support for OTC and RFQ processes, whereby requesting committed quotes from multiple brokers and OTC desks

- Algo order parent/child display

Crypto specific features

- Automatic withdrawals and deposits, i.e. automatic re-balancing of crypto assets across exchanges

- Account/deposit events via WebSocket

- Handling of crypto fees

- Crypto adapter order reconciliation on WebSocket reconnect

- Automated handling of per-instrument limits as well as exchange rate limits

- Encryption of API keys

AlgoTrader API

Multiple API options offer the integration into your existing system landscape using standard technology.

- Inbound FIX 4.4 API supporting simple orders, execution algos, RFQ, and market data

- Inbound REST interface to access all features of the platform

- Real-time event notifications via WebSocket API

AlgoTrader also includes an intuitive UI for the management keys where API keys can be generated and managed. Generated API keys can be used both with the REST/Websocket interface as well as the FIX interface.