2021 was an exciting year for AlgoTrader with lots of traction through both our buy- and sell-side clients. As crypto adoption and prices have grown steadily over the last few years, this new asset class continues to attract institutional investors and fosters the growth of AlgoTrader. With 2021 coming to an end, our insights report highlights some key metrics and provides an outlook for next year.

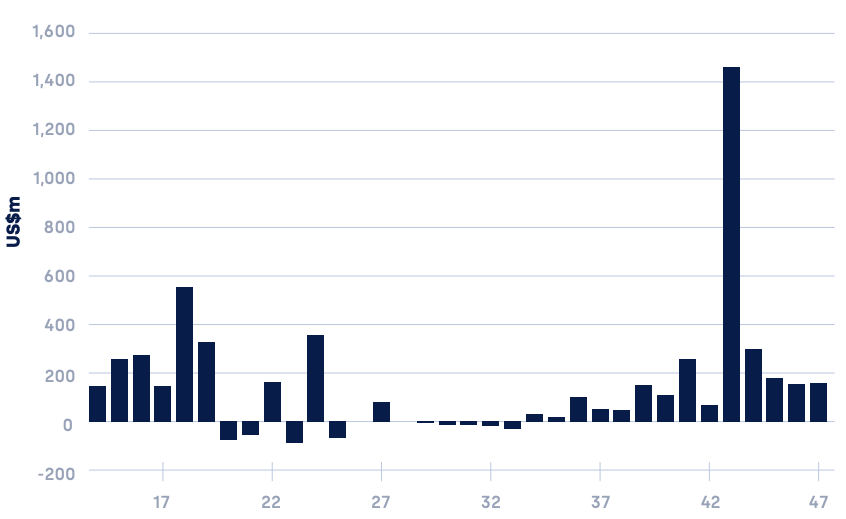

Numerous indicators suggest that crypto and digital assets are gaining traction among institutions. As data from CoinShares shows, there have been positive inflows into crypto products and funds for a large majority of the past 12 months. In fact, $9.2 billion has been invested into such products and funds so far in 2021, which already marks a 37% increase over the $6.7 billion invested over the whole of 2020.

Weekly Crypto Asset Flows (US$m)

Data: 2020/21 week number. Source: CoinShares.

There are many potential drivers for this influx of investment, with some viewing it as a hedge against inflation risk and others simply seeking the potential returns not available in most other asset classes. In addition, the launch of Bitcoin and Ethereum exchange traded funds (ETFs) in the US and Canada have given investors a new way to access the digital asset sector.

Finally, some banks simply want to create a digital asset trading offering in response to client demand. This growing momentum was reflected in the November 2021 edition of Bloomberg’s Crypto Outlook. In analyzing the comparative performance of digital assets relative to their traditional counterparts, it bluntly stated that money managers who have no exposure to crypto “risk falling behind and underperforming peers that own crypto assets.”

A New Market Needs New Infrastructure

Buy-side and sell-side institutions engaging in crypto and digital assets for the first time will note that it exhibits key structural differences to traditional markets like equities.

Firstly, unlike traditional equities, there is no principal exchange for digital assets in each country or territory. Instead, digital assets are traded globally through a large and fragmented network of liquidity venues, including over 300 spot exchanges, local brokers, OTC desks, and market makers. To make the picture more complex, decentralized exchanges (DEXs) — which use smart contracts and liquidity pools to avoid the need for centralized intermediaries — have been rapidly growing in popularity recently.

A recent Chainalysis report on cryptocurrency exchanges showed that large DEXs have experienced over 500% growth in transaction volume between August 2020 and August 2021. Although DEXs pose certain regulatory obstacles for institutions, trading technology providers like AlgoTrader are currently working on ways to integrate them into their product offerings in a secure and compliant manner.

A second key difference relates to technical norms. While traditional assets are traded using the standardized Financial Information eXchange (FIX) protocol, digital asset exchanges tend to use non-standard REST & Websocket application programming interfaces (APIs).

These factors have important operational implications for institutions. The highly fragmented nature of digital asset liquidity may make it difficult and expensive to fill large orders at a single venue due to frontrunning and thin order books. However, institutions want to avoid the counterparty risk and inefficiency of holding funds in multiple exchange accounts simultaneously.

As a result, a growing number of institutions and traders are using specialized digital asset platforms like AlgoTrader along with tailored Smart Order Routing (SOR) and trade execution algorithms to interface with multiple digital asset liquidity venues and achieve better order execution. This helps clients connect to a wide array of venues with minimal friction and achieve best price execution, while minimizing problems such as slippage, frontrunning and counterparty risk.

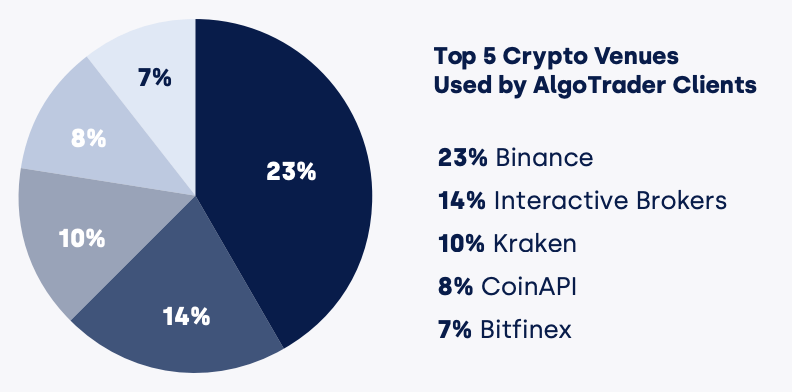

Top 5 Crypto Venues Used by AlgoTrader Clients

In this light, we thought it might be interesting to take a look at some anonymized AlgoTrader data to get a sense for which venues clients are connecting to most frequently and observe any changes in venue usage patterns over time.

The pie chart below illustrates the top 5 adapters that the largest number of our clients connected to from January to November 2021. Binance comes in first place, although it should be considered that this figure aggregates four discrete Binance adapters targeted at different sectors of the market: Binance Global, Binance US, Binance USDT Futures, and Binance Coin Futures.

Interestingly, the second most requested adapter was Interactive Brokers, a venue which is primarily focused on stocks, options, futures, currencies, bonds and funds in traditional finance. This indicates that some clients have adopted trading strategies that combine digital and traditional assets and are using AlgoTrader as an automated bridge between the two.

Interactive Brokers is followed by three other familiar names in the cryptocurrency space — Kraken, CoinAPI and Bitfinex. The presence of CoinAPI among the top 5, a digital asset data provider, illustrates the importance of accessible real-time data in algorithmic digital asset trading.

Venue Diversity

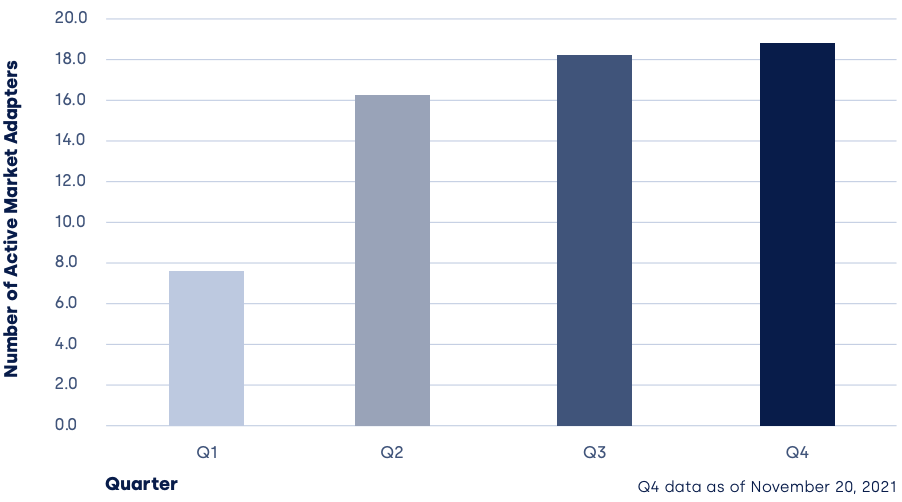

Diving a bit deeper into the numbers, a trend can be observed whereby clients are connecting to an increasing number of venues and data providers simultaneously. As discussed in Section 2 above, this increase likely reflects a growing understanding among clients of the need to increase connectivity in a market with highly fragmented liquidity.

The following graph illustrates that the average number of actively used adapters on AlgoTrader has steadily grown each quarter in 2021, from 7.3 in Q1, to 16.3 in Q2, 18.7 in Q3, and 19 so far in Q4. While this partially reflects the growth in the range of liquidity venues and data providers available on the AlgoTrader platform over the course of the year, it also suggests that in a fragmented field, clients want broader connectivity. While we expect the number of active adapters to continue to grow in 2022, the slowing growth curve suggests that AlgoTrader’s existing range of liquidity venues is now largely satisfying client needs.

An examination of anonymized client level data also supports this trend. It shows that over the entire period of observation from January to November, 68% of clients have used more than one market adapter simultaneously.

Analysis of the data from November in isolation shows that 75% of clients currently connect to more than one market adapter.

Average Number of Active AlgoTrader Adapters

Similarly, the most recent available data from November shows that clients connect to 2.9 market adapters simultaneously on average so far in Q4, larger than the corresponding figures of 2.3 for Q1, 2.7 for Q2, and 2.8 for Q3. However, this figure varies substantially from client to client, with some focusing on a few venues in a specific segment like futures, while others connect to as many as 10 market adapters simultaneously across the sector.

Broad Connectivity is Key to Success

Amid impressive returns and warnings not to fall behind their crypto-savvy counterparts, digital assets are gaining increasing traction among institutions and professional traders. But these new opportunities also come with new challenges. Highly fragmented liquidity and a lack of standardized protocols in the digital asset sector pose significant operational issues for institutions.

Faced with fragmented liquidity, it seems that both buy-side and sell-side clients are seeking to reduce transaction costs and ensure reliable trade execution by connecting to more venues simultaneously. The data analyzed in this report shows that the number of active connections to liquidity venues and data providers on AlgoTrader has steadily increased over the course of 2021, both on aggregate, and on the level of individual clients.

We expect this trend to intensify in 2022 as a growing number of clients seek to optimize digital asset trade execution and settlement. In addition, in response to growing client demand and to facilitate diversification, AlgoTrader will further expand the number of trading venues on the platform in 2021, incorporating some DEXs in the process.