The valuation of crypto and digital assets can be a difficult endeavor due to their short history and, at times, novel econometrics. Yet, as Decentralized Finance (DeFi) contains cashflow generating tokens, classic valuation methods like Discounted Cash Flow (DCF) can be applied to those projects – creating comparability even to traditional financial instruments with the same business model, thus highlighting the profitability of DeFi projects.

Valuing an asset is never easy, and often even the most elaborate forecasting method is of little interest to capital markets. At least the temporary price development depends not least on how many investors orient themselves to one of several competing models. In the case of crypto and digital assets, their short history and the constant metamorphoses of those existing projects add to the difficulties.

One of the main criticisms of crypto assets is the lack of capital gains or cash flow. This general criticism is misguided, because while it applies to many crypto assets such as Bitcoin, it is far from all of them. For this article, we just look at token, which have an inherent cash flow produced by the protocol. Therefore, we exclude lending or mining as a source of income. Besides staking protocols, the world of Decentralized Finance (DeFi) is a very interesting use case for cash flow generation. Therefore, in contrast to Bitcoin, established approaches to business valuation can also be used in the valuation of these projects.

The Discounted Cash Flow (DCF) method is the best-known type of earnings-based valuation. The approach is simple and easy to understand. Another option is to use conventional valuation ratios such as sales and profit in relation to market value. This approach is also called Comparable Company Approach and can easily be applied to tokens within a sector. For example, projects in a sector such as Decentralized Exchanges (DEXs) can be directly compared with each other.

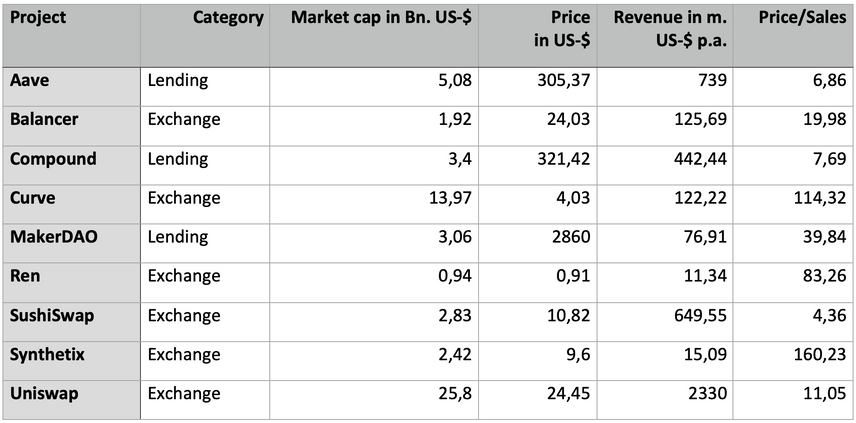

Cash flows in DeFi can be generated by providing liquidity in a pool. In addition, some protocols have a fee switch that distributes a portion of the generated revenue to token holders. Figure 1 shows a selection of different DeFi tokens.

Source: Token Terminal by 12.11.21

For a simple comparison, we focus on the price/sales ratio, the quotient of a project’s market value and its annualized sales. The data provider Token Terminal uses a forward-looking sales estimate based on a simple 30-day moving average. For the equity analysis we use forward earnings estimates as well. Regarding the market cap of the tokens mentioned, we use the total value adjusted for dilution. This approach is well known for the valuation of stocks. The provider Token Terminal determines this value on the basis of the fully diluted supply. In the world of shares, the term “fully diluted” refers to the number of all securities that would exist if all outstanding options on shares and conversion rights were exercised. Before acquiring a long-term position, investors should therefore also consider the offering schedule of the underlying tokens. The fully-diluted approach leads to higher ratios or put another way to a more expensive valuation. Thus, it’s a more conservative measure.

A clear dispersion in the valuation of the individual tokens can be discerned. Not all projects are lumped together. For example, the lending platform Aave is valued much more favorably than its competitor MakerDAO with regard to this key figure.

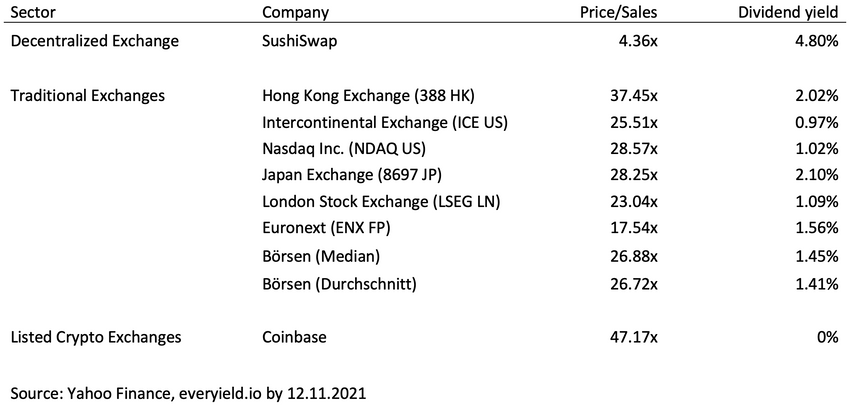

For some projects, a direct comparison with listed stock corporations is useful. This is particularly useful in the case of matching business models, such as the comparison of a DEX with its traditional counterparts. An example of such a trading venue is SushiSwap, whose SUSHI token has unmistakable characteristics of a stock. For example, a portion of the proceeds from exchange transactions is distributed to SUSHI token holders. Via a smart contract, SushiSwap programmatically ensures the correct distribution. Additionally, governance rights are associated with ownership of the tokens, granting the owner a say in changes to the SushiSwap protocol. These rights are comparable to the voting rights of the owner of a common share.

The table in Figure 2 shows an evaluation of common ratios of SushiSwap and some listed companies. The key figures of the listed companies are based on forward earnings.

There is no sign of the often-postulated valuation bubble in this token. The key figures will positively surprise many, because profits are not the first thing most start-ups can advertise.

One of the reasons for early profitability is the very low-cost structure of a decentralized organization. Once such a construct is set up correctly, it runs by itself and is merely expanded and improved in the ongoing process. Investors are therefore able to evaluate new protocols using traditional tools. The on-chain world even makes it possible to run these models in real time. Waiting for audited balance sheet data has thus become obsolete.

The lack of transparency of crypto assets is often cited as an obstacle for investors. This impression is based primarily on the rapidly growing number of tokens and the difficulty of obtaining meaningful information about certain projects. However, investors are familiar with these problems from conventional investments as well, and they by no means apply to all tokens. It is not only in the DeFi segment that both transparency and speed of data availability are higher than in conventional asset classes. Moreover, investors are not dependent on the interpretation of often wishy-washy statements in companies’ mandatory disclosures.

In the future, other assets will have to be measured against the transparency of many crypto assets and the possibility of real-time analysis.

This article is a guest contribution by Martin Leinweber and Jörg Willig in context of their new book on crypto asset allocation, and only reflects the authors’ private opinions.